401k max contribution calculator

For 2022 the 401k contribution limit is 20500 in salary deferrals. Loan Term Years Months.

Employer 401 K Maximum Contribution Limit 2021 38 500

Our combination calculator will allow you to calculate the number of combinations in a set of size n.

. Our most customizable 401k for business owners who want to maximize savings and receive dedicated support. The standard max 401k 2022 limit is 20500. Traditional IRA vs Roth IRA.

You can only contribute a certain amount to your 401k each year. Below is a chart that further breaks down the 401k contribution limits for 2022 according to IRSgov. While there are similarities between a 457b and a 401k there are also key differences to keep in mind.

In 2022 the individual limit is 20500 or. Individuals over the age of 50 can contribute an additional 6500 in catch-up contributions. If youre starting a new 401k.

This contribution limit applies to. How to Max Out a 401k. A seamless Safe Harbor 401k for small businesses that want to make an employer contribution.

A 401k for businesses that want the flexibility to pick and choose features to meet their goals. Property Tax per year. Check with your plan administrator for details.

Yes you can max out both your 401k and 457 plan up to the maximum allowed by the IRS which is 20500 for each account. 401k plans 403b plans the federal Thrift Savings Plan and most 457 pension plans. Loan Calculator Required field.

Please note that your 401k or 403b plan contributions may be limited to less than 80 of your income. Additional contribution limits may apply to Highly Compensated Employees. Stock Market News - Financial News - MarketWatch.

Contributions to a traditional 401k are always tax-deductible. What you provide as the employee and the match from your employer if applicable. Meanwhile there are 401k annual contribution limits.

Both plans allow you to contribute money towards retirement on a tax-deferred basis. Contribution limits. You dont want to lose out on years of compounding interest.

Loan Amount Interest Rate per year. Plus if youre over age 50 you get a larger catch-up contribution maximum with the 401k 6500 compared to 1000 in the IRA. According to a Vanguard study only 12 of plan participants managed to max out their 401k in 2019.

When saving for retirement your employer may give you a hand by offering a tax-advantaged savings planYour options might include a 401k plan or a 457b plan. A combination describes how many sets you can make of a certain size from a larger set. The Rockport Walk Test calculator will use this information to calculate your VO2 max and METs or metabolic equivalents how much energy your body uses at rest.

401k Save the Max Calculator. They require an employer contribution that immediately vests. Many employers offer a match based on a percentage of your gross income.

Well track your 401k plans balances transactions and deferrals. This is a great way to maximize your tax advantages for those looking to quickly bulk up their retirement accounts. It will even tell.

For 2021 and 2022 6000 per year 7000 per year for those age 50 or older. If you havent already started to max out your 401k by this age then really start thinking about what changes you can make to get as close as possible to that 19500 per year contribution. For the tax year 2022 which youll file a return for in 2023 that limit stands at 20500 which is up 1000 from the 2021 level.

For example if you have 5 numbers in a set say 12345 and you want to put them into a smaller set say a set of size 2 then the combination would be. Theres no limit to how much money you can put in an annuity. For 2022 20500 per year 27000 per year for those 50 or older.

Calculator Estimate your 401k plan costs. While your plan may not have a deferral percentage limit this calculator limits deferrals to 80 to account for FICA Social Security and Medicare taxes. This is an increase from the limit of 19500 that was set for 2020 and 2021.

Yet most people dont know how to max out a 401k. VO2 max or maximal oxygen consumption is commonly used by health professionals as an indicator of aerobic capacity or how much oxygen your body can transport. Extra Payment a Month.

Contributing the max to both accounts results in a total tax deferral of 41000 per year not including catch-up contributions. Average 401k Balance at Age 35-44 224871. There are two sides to your contribution.

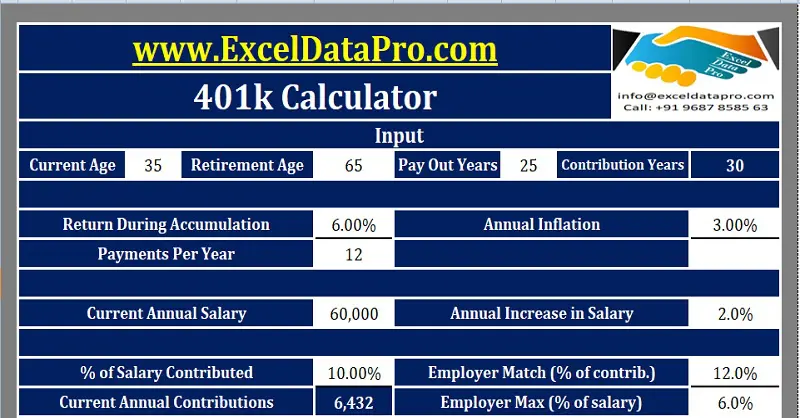

Download 401k Calculator Excel Template Exceldatapro

401k Employee Contribution Calculator Soothsawyer

Free 401k Calculator For Excel Calculate Your 401k Savings

The Maximum 401k Contribution Limit Financial Samurai

The Maximum 401k Contribution Limit Financial Samurai

401 K Calculator See What You Ll Have Saved Dqydj

Customizable 401k Calculator And Retirement Analysis Template

Doing The Math On Your 401 K Match Sep 29 2000

401k Employee Contribution Calculator Soothsawyer

Here S How To Calculate Solo 401 K Contribution Limits

Excel 401 K Value Estimation Youtube

Retirement Services 401 K Calculator

401k Contribution Calculator Step By Step Guide With Examples

401k Contribution Calculator Step By Step Guide With Examples

Download 401k Calculator Excel Template Exceldatapro

I Created A Little Calculator To Figure Out Exactly What My 401k Contribution Election Should Be To Front Load It Early Each Year Reach The Annual Max And Still Get The Full

Solo 401k Contribution Limits And Types